Give

Planned Giving

A Tradition of Charitable Giving…A Plan for the Future

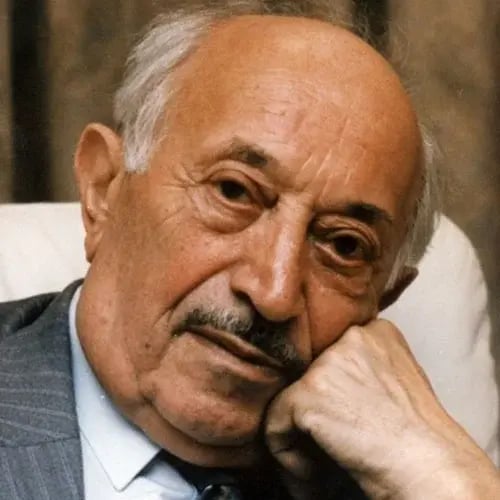

Just as you plan for your future and that of your loved ones, the Simon Wiesenthal Center must plan for its future. We must be prepared to face new challenges, anticipate worldwide trends and provide creative measures to battle antisemitism, hatred, and injustice.

There are philanthropic tools available that can benefit you and your loved ones while helping to secure the Center’s future. You can perpetuate your commitment to the Center and at the same time benefit from the form of philanthropy known as Planned Giving.

The Simon Wiesenthal Center recognizes that there is much more to charitable giving than the desire for tax benefits. As everyone’s needs and objectives are unique, it is imperative to consult with your own tax and legal advisers. Our team of development professionals are prepared to work along with your estate and financial planners to provide all the necessary information specific to meet your objectives.

Interested in learning more about Planned Giving? Contact Jim Berk, CEO, Simon Wiesenthal Center, by clicking the button below:

Planned Giving Opportunities

-

Bequests

The Simon Wiesenthal Center* has been the designated beneficiary in numerous wills of generous donors from all over the United States and Canada. A great deal of our proactive social action and educational efforts can be directly linked to these generous individuals. These donors named the

Simon Wiesenthal Center, alongside their loved ones, as beneficiaries of their wills and received all the appropriate recognition associated with their generous major gifts.

Simon Wiesenthal Center, alongside their loved ones, as beneficiaries of their wills and received all the appropriate recognition associated with their generous major gifts.Your testamentary charitable bequest ensures that your support of the Simon Wiesenthal Center will continue in perpetuity. It is possible to designate a special purpose or program for your bequest, keep in mind, the specific needs of the Center may change depending on the future state of world events. Therefore, it is preferable to authorize the Center to use the bequest for its general charitable purposes in the event the designated use is determined to be inapplicable.

There are many types of Bequests:

Outright Bequest - The Simon Wiesenthal Center is given a specific dollar amount or a specific asset, such as securities or marketable real estate.

Residuary Bequest - The Simon Wiesenthal Center is given all or a percentage of the remainder of the estate after payment of all expenses of the estate and any other specific amounts bequeathed to other beneficiaries of the will.

Testamentary Trust - You may provide for income to be paid from the trust to a designated beneficiary, and after that individual's lifetime all or part of the principal passes to the Center.

Contingent Bequest - You may have family and friends for whom you feel a responsibility and choose to provide for them first in your will. The Center is given a bequest only if the designated beneficiarie(s) predecease you.

The provisions in your will or revocable living trust for leaving a charitable bequest to the Simon Wiesenthal Center, Inc. will depend upon the type of gift and your unique circumstances. We hope these sample bequest clauses will be helpful to your attorney.

Sample Bequest Clauses

Unrestricted General Legacy (Outright Bequest)

I bequeath to the Simon Wiesenthal Center, Inc., a California not for profit public benefit corporation, having its principal offices at 1399 South Roxbury Drive, Los Angeles, California 90035, the sum of ($________) DOLLARS for its general charitable purposes.Bequest for Specific Purpose

I bequeath to the Simon Wiesenthal Center, Inc., a California not for profit public benefit corporation, having its principal offices at 1399 South Roxbury Drive, Los Angeles, California 90035, the sum of ($________) DOLLARS [OR] a percentage (%________) of my residuary estate to be used for the Simon Wiesenthal Center [insert specific purpose designation]*. If in the opinion of the Board of Trustees, the purposes of the Simon Wiesenthal Center would be better served by using the income or principal, or both, for the Simon Wiesenthal Center's general purposes, the income or principal, or both may be so used.Bequest for Specific Purpose by Endowment

I bequeath to the Simon Wiesenthal Center, Inc., a California not for profit public benefit corporation, having its principal offices at 1399 South Roxbury Drive, Los Angeles, California 90035, the sum of ($________)DOLLARS [OR] a percentage(%________) of my residuary estate to establish an endowment fund bearing the name of________________ . The net income therefrom shall be used for the benefit of The Simon Wiesenthal Center [insert specific purpose designation]*. If, in the opinion of the Board of Trustees, the purposes of the Simon Wiesenthal Center designated program would be better served by using the income and principal of the fund, they may have the discretion to do so.*The Simon Wiesenthal Center, Inc. is a tax-exempt nonprofit corporation as described under Section 501(c)(3) of the Internal Revenue Code; the Federal Tax Identification Number: 95-3964928. Gifts and Bequests to the Simon Wiesenthal Center are tax deductible to the full extent provided by law.

Interested in learning more about Bequests:

-

Lifetime Gifts of Appreciated Property

There are tax benefits in giving gifts of appreciated property such as marketable securities. You can eliminate the tax on the gains you would otherwise be subject to, you can reduce your income tax and, you can make a larger gift to the Simon Wiesenthal Center at less cost to you.

Interested in learning more about Lifetime Gifts:

-

Gifts of Stock and Securities

A gift of appreciated stock or securities will go a long way to help the Simon Wiesenthal Center, as well as provide you with a significant income tax deduction for the full market value of the stock. The following instructions will help you facilitate a gift of stock or securities. (Note: To receive the full tax benefit, stocks must be transferred to the Simon Wiesenthal Center before they are sold):

Notification of Donor Intent

For the purposes of proper acknowledgment and auditing, either the transferring broker or you must provide the following information:

- Your name and complete address

- The number of shares and name of stock or securities transferredSecurities Delivered Electronically

The following information will enable your broker to facilitate an electronic transfer of stock or securities:

Brokerage: Morgan Stanley

9665 Wilshire Blvd.

Suite 600

Beverly Hills, CA 90212DTC Number: 0015 Account Name: Simon Wiesenthal Center, Inc. Account Number: 238-060490-112 Contact: David Doll

310-285-4881

david.e.doll@morganstanley.comInterested in learning more about Gifts of Stock and Securities:

-

Charitable Remainder Trust

The charitable remainder trust is an effective way to make a gift to the Simon Wiesenthal Center while retaining the income benefits.

Charitable remainder trusts are individually managed and may be tailored to your specific needs. There are two forms of charitable remainder trusts: the charitable remainder annuity trust and the charitable remainder unitrust.

When you make a gift of cash or appreciated securities to the Simon Wiesenthal Center, you (or you and another beneficiary, such as a spouse) can choose to receive the income for life. You can also choose whether you want your annual income payments to be a fixed dollar amount, based on the value of your gift at the time you establish the trust (annuity trust), or whether you want your annual income payments to take the form of an annual percentage of the trust's principal, computed from year to year (unitrust). Both trusts require by law, that the percentage payment to you be no less than a specified percent (5% of the initial fair market value in the case of an annuity trust; and 5% of the trust property, valued annually, in the case of a unitrust).

What are the benefits?

When you establish the charitable remainder trust with the Simon Wiesenthal Center, you receive an immediate tax deduction. The allowable amount of the tax deduction is calculated by federal tables and various other factors such as; the age(s) of the income beneficiarie(s), the rate of return of the lifetime income payments and value of the remainder interest the Simon Wiesenthal Center will receive. Your individual income tax circumstances will determine whether in some limited situations the alternative minimum tax is applicable. After the term of the trust, the remainder assets are transferred to the Simon Wiesenthal Center as a permanent gift. The Center will thereby be reminded of your commitment to our mission in perpetuity.

Interested in learning more about Charitable Remainder Trusts:

-

Life Insurance

A charitable gift of life insurance is an innovative way to provide a highly leveraged endowment to the Simon Wiesenthal Center. There are several ways to gift life insurance. You may contribute a new or existing policy by transferring the policy to the Simon Wiesenthal Center and naming the Center as owner and beneficiary. There are substantial benefits to both you and the Center. The premium payments will provide you with an income tax deduction. The endowed gift to the Center will be substantially larger than the amount used to fund the insurance policy. The insurance policy proceeds pass directly to the Center outside your estate and are not subject to probate or estate taxation. Therefore, your estate will be undiminished by the gift. You may wish to add the Simon Wiesenthal Center to an existing policy as a remainder beneficiary or you can utilize the values in an existing policy to fund a more highly leveraged one. Since life insurance premiums are based or mortality rates, gifts of life insurance are extremely affordable for younger donors, affording them the opportunity to make sizable gifts.

There are various creative ways that life insurance combined with charitable trusts can be utilized as asset replacement plans.

A Wealth Replacement Trust transfers property free of federal estate and state inheritance taxes and often provides an even greater inheritance for your heirs. A wealth replacement trust is a sophisticated charitable estate planning tool utilizing a charitable remainder trust coupled with life insurance. It replenishes estate values for your children or other intended beneficiaries through the purchase of life insurance. You can provide a lasting legacy to the Simon Wiesenthal Center and to your heirs.Interested in learning more about a charitable gift of life insurance:

-

Charitable Lead Trusts

A charitable lead trust can be an effective estate planning tool to transfer the assets to your heirs with significant tax advantages while making a meaningful gift to the Simon Wiesenthal Center. You can establish a lead trust that will make income payments to the Center for a pre-determined term of years. After the trust term, the assets are distributed to you or your heirs. There are two types of lead trusts: the grantor lead trust and the non-grantor lead trust.

Grantor Lead Trusts

As a grantor lead trust donor, you contribute assets to a trust, which makes payments to the Simon Wiesenthal Center for the duration of the trust. When the trust terminates, the assets revert to you and/or your spouse. When you establish a grantor lead trust, you are entitled to an immediate income tax charitable deduction equal to the present value of the income stream, the Simon Wiesenthal Center will receive during the life of the trust.Non-Grantor Lead Trusts

As a non-grantor lead trust donor, you contribute assets to a trust, which makes payments to the Center for the trust term. When a non-grantor trust terminates, the assets are transferred to someone other than you and/or spouse, usually your children or grandchildren. When you create a non-grantor lead trust, you do not qualify for an income tax charitable deduction, however, you will enjoy a substantial reduction in estate and gift taxes on the future transfer of assets to your heirs.Interested in learning more about Charitable Lead Trusts:

-

Retirement Plans

You may wish to designate the Simon Wiesenthal Center as beneficiary of your retirement plan. When you designate your children or other heirs as beneficiaries, they receive only a small fraction of the plan's value since inherited assets of retirement plans (such as IRA's, 401k's, Keogh Plans and others) are subject to both estate and income tax. You would be making a substantial donation to the Center at a minimum cost to your family with plan assets that would be otherwised subject to tax.

Interested in learning more about giving through Retirement Plans:

* The Simon Wiesenthal Center, Inc. is a qualified tax-exempt nonprofit corporation under Section 501(c)(3) of the Internal Revenue Code. The tax identification number is 95-3964928. This information is intended to provide general gift planning education. Our organization is not qualified to provide specific legal, tax or investment advice, and this source should not be looked to relied upon as a source for such advice. Consult with your legal and financial advisors before making any gift.